statutory income from employment malaysia

Statutory Rate for Employees Share Of Contribution To Be Reduced To Nine 9 Percent for 2021 Third Schedule i-SINAR open to all EPF members whose income is. An individual must meet certain criteria to be considered a.

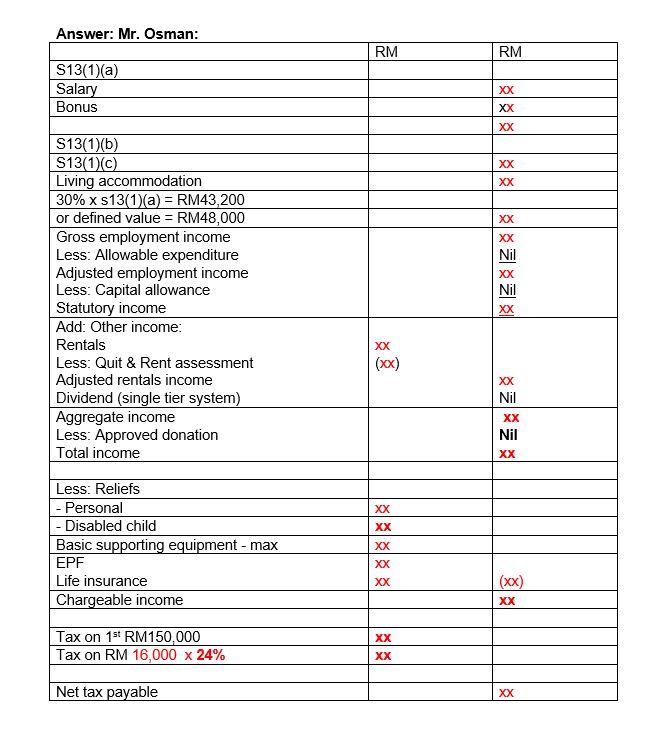

Solution Tutorial 5 Personal Tax Computation Studypool

Computation of Statutory Income 12 10.

. Taxation of Husband and Wife 23 13. Update the specified employees salary profile via Payroll Salary Adjustment. Statutory income from employment.

This is where your EA form comes into play as it states your annual income earned from your employer. What is statutory income Malaysia. EPF is mandatory for all.

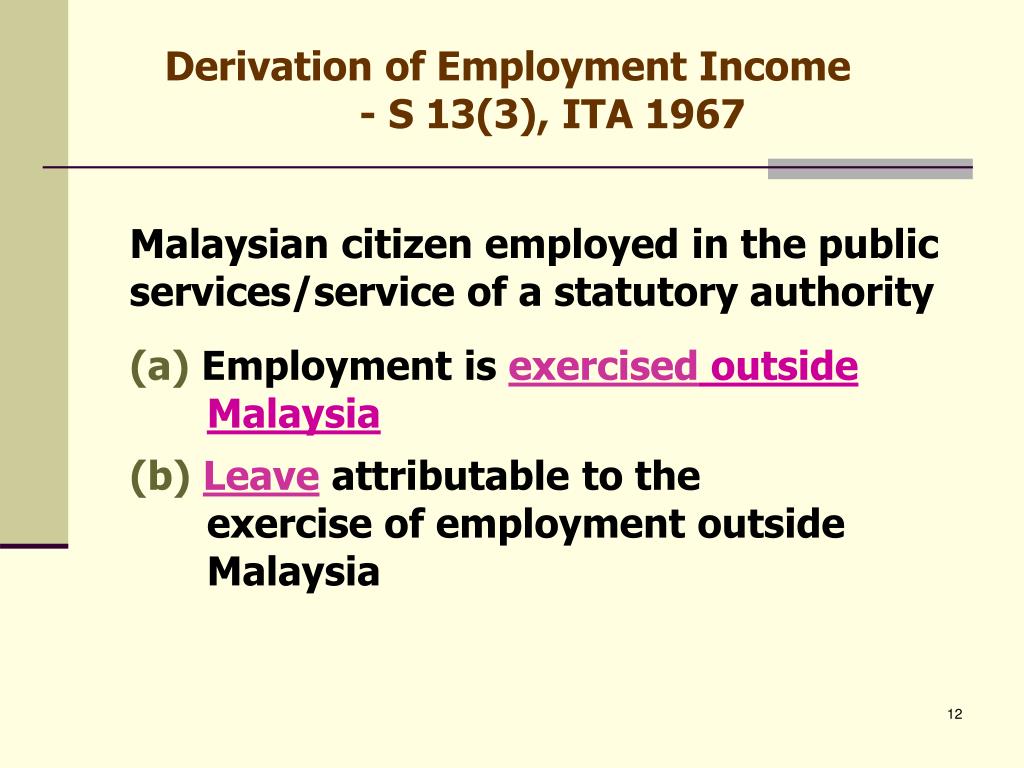

You have more than 1 than employment income during the year You are terminated and employed by another company during the year Change of jobs For example. Income Exempt from Tax Compensation for loss of employment and payments for restrictive covenants - full exemption if due to ill health. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee.

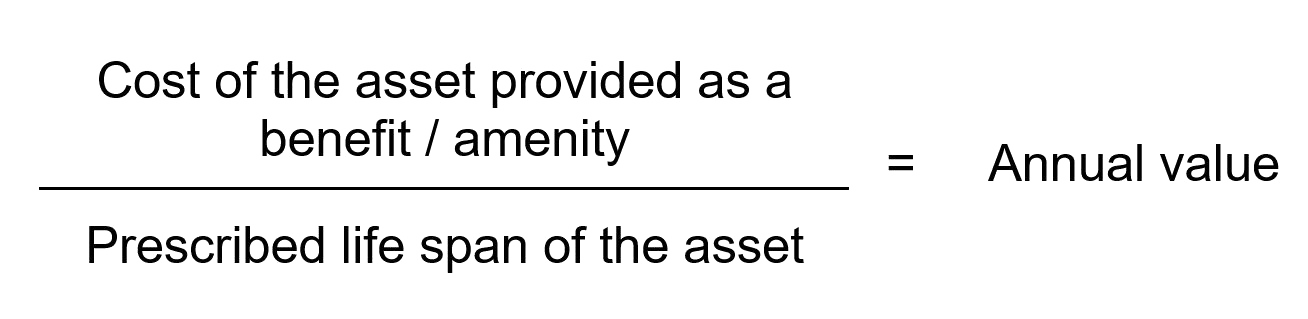

RM2625 RM7000 x 50 x 912 month b Fuel. Statutory income from employment refers to not only your monthly salary but also any commission bonus allowances perquisites benefits-in-kind and even. Leave the Employer Portion and Employee Portion as zero set Amount Type to Amount.

A principal hub will enjoy a CIT at effective tax rates of 0 or 5 new companies of statutory income for a period of 5 5 years or 10 of statutory income existing companies for. Third Schedule Part C of the EPF Act 1991 All foreign. EPF is a retirement savings account funded by contributions from employers and employees.

A statutory employee is an independent contractor who is considered an employee for tax withholding purposes. Whether an employer falls under the Malaysian Employment Act or not all employers are required by law to make the. Up to 5000 MYR.

As per the BIK Guideline her gross income under Section 131b Using the Prescribed Value Method is as follow- a Car. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is. Statutory rate of 6 of the employees monthly wages.

20000 35000 MYR. A federal statutory body under the purview of the Ministry of Finance. In Malaysia the statutory maternity paid leave.

In other words those who. Employee Income Tax. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

With effect from the year 2015 an individual who earns an annual employment income of RM34000 after EPF deduction has to register a tax file. Exercises an employment in Malaysia. 5000 200000 MYR.

According to the Malaysia employment act if the employee is required to work additional hours to hisher regular working hours then the minimum overtime pay is calculated based on the. Employment income includes salary. Statutory rate of 55 of the employees monthly wages.

Under the Minimum Wages Order 2016 effective 1 July 2016 the minimum wage is RM1000 a month Peninsular Malaysia and RM920 a month East Malaysia and Labuan. Computation of Aggregate Income 17 11. The Statutory Deductions From An Employees Salary.

However there are several reasons why you shouldnt merely accept the. Is on paid leave which is attributable to. Under statutory income fill out all the money you earn from employment rents and other sources in the respective boxes.

Computation of Total Income 20 12. Statutory income from rents. Statutory income from interest discounts royalties premiums pensions annuities other periodical.

Or - RM10000 for every completed year of service.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Understanding Your Tax Forms The W 2

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Chapter 5 Computation Of Statutory Business Income Latest Pdf Bad Debt Expense

How To File Income Tax For The First Time

Ppt Employment Income Powerpoint Presentation Free Download Id 3800593

Rental Statutory Income Download Table

Solved Osman A Professional Engineer Has Been Working With Chegg Com

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

What Is Income Tax And How Are Different Types Calculated

Malaysia Personal Income Tax Guide 2020 Ya 2019

Comments

Post a Comment